A Guide to Multi-Agent AI Systems

A junior loan officer who handles data acquisition, risk assessment, and closing decisions alone is prone to making mistakes because the role is so demanding at once. A similar weakness comes from monolithic AI agents asked to run complex, multi-stage workflows. They lose context, skip steps, and produce shaky thinking, leading to unreliable results.

A strong approach is to build AI as a supervised professional team that enforces order and accountability. This reflects professional collaboration and produces consistent, readable decisions in advanced domains such as lending. In this article, we build such an integrated system, not as a single hyperactive agent, but as a disciplined group.

What is a Managing Agent?

A manager agent is a specialist who is no longer an agent who performs a task, but a facilitator of a group of other agents working on a specific task. Consider it the head of your AI staff.

Its key responsibilities include:

- Division of Work and Transfer: The manager takes the incoming request and divides the request into logical sub-tasks which are then forwarded to the appropriate special agent.

- Workflow Orchestration: It is robust in terms of application. In the case of our loan review, that means data retrieval, policy review, and only after that, a recommendation.

- Quality control: It checks the performance of every worker agent to see if it is at the required level before the next step.

- Summary of Results: Once all agents have completed their work, the manager takes the results of the workers and combines them to provide a final, consistent result.

The result of this pattern is very robust, scalable and easy to debug. Agents are assigned a single task and this eases their mind and increases their operational efficiency.

Hand Open: Auto Loan Review with Manager

A system for the initial review of loan applications is now being developed. We intend to take the identity of the applicant, analyze him according to the company’s risk criteria, and advise on the short course of action to be taken.

Our AI team will include:

- Case Taking Agent: Front desk specialist. It collects the applicant’s financial information and makes a summary.

- Risk Policy Review Agent: Analyst. It matches the applicant’s information with a series of pre-established lending criteria.

- Lending Decision Agent: The decision maker. It takes the findings and suggests a final course of action such as approving or rejecting the loan.

- Manager: A manager who executes the entire workflow and ensures that every agent does something in the right order.

Let’s build this finance team.

Step 1: Install Dependencies

Our system will be based on LangChain, LangGraph, and OpenAI. LangGraph is a library developed to build multi-agent multi-state workflows.

!uv pip install langchain==1.2.4 langchain-openai langchain-community==0.4.1 langgraph==1.0.6 Step 2: Configure API Keys and Location

Set your OpenAI API key to enable our language models. The cell below will prompt you to enter your key securely.

import os

import getpass

# OpenAI API Key (for chat & embeddings)

if not os.environ.get("OPENAI_API_KEY"):

os.environ["OPENAI_API_KEY"] = getpass.getpass(

"Enter your OpenAI API key (

)Step 3: Import

The description of the landscape, tools, and agents will require several elements of our libraries.

from typing import Annotated, Literal

from typing_extensions import TypedDict

from langgraph.graph.message import add_messages

from langgraph.graph import StateGraph, START, END

from langchain_openai import ChatOpenAI

from langgraph.types import Command

from langchain_core.tools import tool

from langchain_core.messages import HumanMessage, SystemMessage, AIMessage

from langchain.agents import create_agent

from IPython.display import display, MarkdownStep 4: Business Logic – Datasets

We will run our system on the bare memory data that will be the presentation of risk policies, loan recommendations, and applicant records. This makes our example self-contained and easy to follow.

risk_policies = [

{

"loan_type": "Home Loan",

"risk_category": "Low Risk",

"required_conditions": [

"credit_score >= 750",

"stable_income >= 3 years",

"debt_to_income_ratio < 30%"

],

"notes": "Eligible for best interest rates and fast-track approval."

},

{

"loan_type": "Home Loan",

"risk_category": "Medium Risk",

"required_conditions": [

"credit_score >= 680",

"stable_income >= 2 years",

"debt_to_income_ratio < 40%"

],

"notes": "May require collateral or higher interest rate."

},

{

"loan_type": "Personal Loan",

"risk_category": "Medium Risk",

"required_conditions": [

"credit_score >= 650",

"stable_income >= 2 years"

],

"notes": "Manual verification recommended for income consistency."

},

{

"loan_type": "Auto Loan",

"risk_category": "Low Risk",

"required_conditions": [

"credit_score >= 700",

"stable_income >= 2 years"

],

"notes": "Vehicle acts as secured collateral."

}

]

loan_recommendations = [

{

"risk_category": "Low Risk",

"next_step": "Auto approve loan with standard or best interest rate."

},

{

"risk_category": "Medium Risk",

"next_step": "Approve with adjusted interest rate or require collateral."

},

{

"risk_category": "High Risk",

"next_step": "Reject or request guarantor and additional documents."

}

]

applicant_records = [

{

"applicant_id": "A101",

"age": 30,

"employment_type": "Salaried",

"annual_income": 1200000,

"credit_score": 780,

"debt_to_income_ratio": 25,

"loan_type": "Home Loan",

"requested_amount": 4500000,

"notes": "Working in MNC for 5 years. No missed EMI history."

},

{

"applicant_id": "A102",

"age": 42,

"employment_type": "Self Employed",

"annual_income": 900000,

"credit_score": 690,

"debt_to_income_ratio": 38,

"loan_type": "Home Loan",

"requested_amount": 3500000,

"notes": "Business income fluctuates but stable last 2 years."

},

{

"applicant_id": "A103",

"age": 27,

"employment_type": "Salaried",

"annual_income": 600000,

"credit_score": 640,

"debt_to_income_ratio": 45,

"loan_type": "Personal Loan",

"requested_amount": 500000,

"notes": "Recent job change. Credit card utilization high."

}

]Step 5: Building Tools for Our Agents

All agents need devices to communicate with our data. They are plain Python functions decorated with the Python decoration tool; which LLM requests when asked to do certain things.

llm = ChatOpenAI(

model="gpt-4.1-mini",

temperature=0.0,

timeout=None

)

@tool

def fetch_applicant_record(applicant_id: str) -> dict:

"""

Fetches and summarizes an applicant financial record based on the given applicant ID.

Returns a human-readable summary including income, credit score, loan type,

debt ratio, and financial notes.

Args:

applicant_id (str): The unique identifier for the applicant.

Returns:

dict: {

"applicant_summary": str

}

"""

for record in applicant_records:

if record["applicant_id"] == applicant_id:

summary = (

"Here is the applicant financial summary report:n"

f"Applicant ID: {record['applicant_id']}n"

f"Age: {record['age']}n"

f"Employment Type: {record['employment_type']}n"

f"Annual Income: {record['annual_income']}n"

f"Credit Score: {record['credit_score']}n"

f"Debt-to-Income Ratio: {record['debt_to_income_ratio']}n"

f"Loan Type Requested: {record['loan_type']}n"

f"Requested Amount: {record['requested_amount']}n"

f"Financial Notes: {record['notes']}"

)

return {"applicant_summary": summary}

return {"error": "Applicant record not found."}

@tool

def match_risk_policy(loan_type: str, risk_category: str) -> dict:

"""

Match a given loan type and risk category to the most relevant risk policy rule.

Args:

loan_type (str): The loan product being requested.

risk_category (str): The evaluated applicant risk category.

Returns:

dict: A summary of the best matching policy if found, or a message indicating no match.

"""

context = "n".join([

f"{i+1}. Loan Type: {p['loan_type']}, Risk Category: {p['risk_category']}, "

f"Required Conditions: {p['required_conditions']}, Notes: {p['notes']}"

for i, p in enumerate(risk_policies)

])

prompt = f"""You are a financial risk reviewer assessing whether a loan request aligns with existing lending risk policies.

Instructions:

- Analyze the loan type and applicant risk category.

- Compare against the list of provided risk policy rules.

- Select the policy that best fits the case considering loan type and risk level.

- If none match, respond: "No appropriate risk policy found for this case."

- If a match is found, summarize the matching policy clearly including any required financial conditions or caveats.

Loan Case:

- Loan Type: {loan_type}

- Risk Category: {risk_category}

Available Risk Policies:

{context}

"""

result = llm.invoke(prompt).text

return {"matched_policy": result}

@tool

def check_policy_validity(

financial_indicators: list[str],

required_conditions: list[str],

notes: str

) -> dict:

"""

Determine whether the applicant financial profile satisfies policy eligibility criteria.

Args:

financial_indicators (list[str]): Financial indicators derived from applicant record.

required_conditions (list[str]): Conditions required by matched policy.

notes (str): Additional financial or employment context.

Returns:

dict: A string explaining whether the loan request is financially justified.

"""

prompt = f"""You are validating a loan request based on documented financial indicators and policy criteria.

Instructions:

- Assess whether the applicant financial indicators and notes satisfy the required policy conditions.

- Consider financial context nuances.

- Provide a reasoned judgment if the loan is financially justified.

- If not qualified, explain exactly which criteria are unmet.

Input:

- Applicant Financial Indicators: {financial_indicators}

- Required Policy Conditions: {required_conditions}

- Financial Notes: {notes}

"""

result = llm.invoke(prompt).text

return {"validity_result": result}

@tool

def recommend_loan_action(risk_category: str) -> dict:

"""

Recommend next lending step based on applicant risk category.

Args:

risk_category (str): The evaluated applicant risk level.

Returns:

dict: Lending recommendation string or fallback if no match found.

"""

options = "n".join([

f"{i+1}. Risk Category: {r['risk_category']}, Recommendation: {r['next_step']}"

for i, r in enumerate(loan_recommendations)

])

prompt = f"""You are a financial lending decision assistant suggesting next steps for a given applicant risk category.

Instructions:

- Analyze the provided risk category.

- Choose the closest match from known lending recommendations.

- Explain why the match is appropriate.

- If no suitable recommendation exists, return: "No lending recommendation found for this risk category."

Risk Category Provided:

{risk_category}

Available Lending Recommendations:

{options}

"""

result = llm.invoke(prompt).text

return {"recommendation": result}

Step 6: Using Sub-Agents (Employees)

Now we are creating our three special agents. Each agent is given a very small system information that defines both what it must do and what tools it is allowed to access, and how to organize its output.

case_intake_agent = create_agent(

model=llm,

tools=[fetch_applicant_record],

system_prompt=r"""

You are a Financial Case Intake Specialist.

THIS IS A RULED TASK. FOLLOW THE STEPS IN ORDER. DO NOT SKIP STEPS.

--- MANDATORY EXECUTION RULES ---

- You MUST call the `fetch_applicant_record` tool before writing ANY analysis or summary.

- If you do not have applicant data from the tool, you MUST stop and say: "Applicant data not available."

- Do NOT hallucinate, infer, or invent financial facts beyond what is provided.

- Inference is allowed ONLY when logically derived from financial notes.

--- STEP 1: DATA ACQUISITION (REQUIRED) ---

Call `fetch_applicant_record` and read:

- Financial indicators

- Financial profile / risk context

- Loan request

- Financial notes

You may NOT proceed without this step.

--- STEP 2: FINANCIAL ANALYSIS ---

Using ONLY the retrieved data:

1. Summarize the applicant financial case.

2. Identify explicit financial indicators.

3. Identify inferred financial risks (label as "inferred").

4. Derive rationale for why the loan may have been requested.

--- STEP 3: VALIDATION CHECK ---

Before finalizing, confirm:

- No financial facts were added beyond tool output.

- Inferences are financially reasonable.

- Summary is neutral and review-ready.

--- FINAL OUTPUT FORMAT (STRICT) ---

Sub-Agent Name: Case Intake Agent

Financial Summary:

- ...

Key Financial Indicators:

- Explicit:

- ...

- Inferred:

- ...

Financial Rationale for Loan Request:

- ...

If any section cannot be completed due to missing data, state that explicitly.

"""

)

lending_decision_agent = create_agent(

model=llm,

tools=[recommend_loan_action],

system_prompt=r"""

You are a Lending Decision Recommendation Specialist.

YOU MUST RESPECT PRIOR AGENT DECISIONS.

--- NON-NEGOTIABLE RULES ---

- You MUST read Intake Agent and Risk Policy Checker outputs first.

- You MUST NOT override or contradict the Risk Policy Checker.

- You MUST clearly state whether loan request was:

- Approved

- Not Approved

- Not Validated

--- STEP 1: CONTEXT REVIEW ---

Identify:

- Confirmed financial profile / risk category

- Policy decision outcome

- Key financial risks and constraints

--- STEP 2: DECISION-AWARE PLANNING ---

IF loan request APPROVED:

- Recommend next lending execution steps.

IF loan request NOT APPROVED:

- Do NOT recommend approval.

- Suggest ONLY:

- Additional financial documentation

- Risk mitigation steps

- Financial profile improvement suggestions

- Monitoring or reassessment steps

IF policy NOT FOUND:

- Recommend cautious next steps and documentation improvement.

--- STEP 3: SAFETY CHECK ---

Before finalizing:

- Ensure recommendation does not contradict policy outcome.

- Ensure all suggestions are financially reasonable.

--- FINAL OUTPUT FORMAT (STRICT) ---

Sub-Agent Name: Lending Decision Agent

Policy Status:

- Approved / Not Approved / Not Found

Lending Recommendations:

- ...

Rationale:

- ...

Notes for Reviewer:

- ...

Avoid speculative financial approvals.

Avoid recommending approval if policy validation failed.

"""

)

risk_policy_checker_agent = create_agent(

model=llm,

tools=[match_risk_policy, check_policy_validity],

system_prompt=r"""

You are a Lending Risk Policy Review Specialist.

THIS TASK HAS HARD CONSTRAINTS. FOLLOW THEM EXACTLY.

--- MANDATORY RULES ---

- You MUST base decisions only on:

1. Intake summary content

2. Retrieved risk policy rules

- You MUST NOT approve or reject without a policy check attempt.

- If no policy exists, you MUST explicitly state that.

- Do NOT infer policy eligibility criteria.

--- STEP 1: POLICY IDENTIFICATION (REQUIRED) ---

Use `match_risk_policy` to identify the most relevant policy for:

- The requested loan type

- The evaluated risk category

If no policy is found:

- STOP further validation

- Clearly state that no applicable policy exists

--- STEP 2: CRITERIA EXTRACTION ---

If a policy is found:

- Extract REQUIRED financial conditions exactly as stated

- Do NOT paraphrase eligibility criteria

--- STEP 3: VALIDATION CHECK (REQUIRED) ---

Use `check_policy_validity` with:

- Applicant financial indicators

- Policy required conditions

- Intake financial notes

--- STEP 4: REASONED DECISION ---

Based ONLY on validation result:

- If criteria met → justify approval

- If criteria not met → explain why

- If insufficient data → state insufficiency

--- FINAL OUTPUT FORMAT (STRICT) ---

Sub-Agent Name: Risk Policy Checker Agent

Risk Policy Identified:

- Name:

- Source (if available):

Required Policy Conditions:

- ...

Applicant Evidence:

- ...

Policy Validation Result:

- Met / Not Met / Insufficient Data

Financial Justification:

- ...

Do NOT recommend lending actions here.

Do NOT assume approval unless criteria are met.

"""

)Step 7: Mastermind – Using the Manager Agent

This is the core of our system. Its constitution is a decision of the manager. It establishes a strict order of work flow and the quality checks it must perform on the output of each agent before proceeding.

class State(TypedDict):

messages: Annotated[list, add_messages]

members = [

"case_intake_agent",

"risk_policy_checker_agent",

"lending_decision_agent"

]

SUPERVISOR_PROMPT = f"""

You are a Loan Review Supervisor Agent.

You are managing a STRICT, ORDERED loan risk review workflow

between the following agents:

{members}

--- WORKFLOW ORDER (MANDATORY) ---

1. case_intake_agent

2. risk_policy_checker_agent

3. lending_decision_agent

4. FINISH

You MUST follow this order. No agent may be skipped.

--- YOUR RESPONSIBILITIES ---

1. Read all messages so far carefully.

2. Determine which agents have already executed.

3. Inspect the MOST RECENT output of each executed agent.

4. Decide which agent MUST act next based on completeness and order.

--- COMPLETENESS REQUIREMENTS ---

Before moving to the next agent, verify the previous agent’s output contains:

case_intake_agent output MUST include:

- "Financial Summary"

- "Key Financial Indicators"

- "Financial Rationale"

risk_policy_checker_agent output MUST include:

- "Policy Validation Result"

- "Financial Justification"

- Either a policy match OR explicit statement no policy exists

lending_decision_agent output MUST include:

- "Policy Status"

- "Lending Recommendations"

- Clear approval / non-approval status

--- ROUTING RULES ---

- If an agent has NOT run yet → route to that agent.

- If an agent ran but required sections missing → route SAME agent again.

- ONLY return FINISH if all three agents completed correctly.

- NEVER return FINISH early.

--- RESPONSE FORMAT ---

Return ONLY one of:

{members + ["FINISH"]}

"""

FINAL_RESPONSE_PROMPT = """

You are the Loan Review Supervisor Agent.

Analyze ALL prior agent outputs carefully.

--- CRITICAL DECISION RULE ---

Your Final Decision MUST be based PURELY on the output of the

lending_decision_agent.

- If lending_decision_agent indicates loan APPROVED

→ Final Decision = APPROVED

- If lending_decision_agent indicates NOT APPROVED or NEEDS INFO

→ Final Decision = NEEDS REVIEW

--- OUTPUT FORMAT (STRICT) ---

- Agent Name: Loan Review Supervisor Agent

- Final Decision: APPROVED or NEEDS REVIEW

- Decision Reasoning: Based on lending_decision_agent output

- Lending recommendation or alternative steps: From lending_decision_agent

"""

class Router(TypedDict):

next: Literal[

"case_intake_agent",

"risk_policy_checker_agent",

"lending_decision_agent",

"FINISH"

]

def supervisor_node(state: State) -> Command[

Literal[

"case_intake_agent",

"risk_policy_checker_agent",

"lending_decision_agent",

"__end__"

]

]:

messages = [SystemMessage(content=SUPERVISOR_PROMPT)] + state["messages"]

response = llm.with_structured_output(Router).invoke(messages)

goto = response["next"]

if goto == "FINISH":

goto = END

messages = [SystemMessage(content=FINAL_RESPONSE_PROMPT)] + state["messages"]

response = llm.invoke(messages)

return Command(

goto=goto,

update={

"messages": [

AIMessage(

content=response.text,

name="supervisor"

)

],

"next": goto

}

)

return Command(goto=goto, update={"next": goto})Step 8: Defining Node functions

Here the functions of the node that will be performing the role of the laggraph node will be explained.

def case_intake_node(state: State) -> Command[Literal["supervisor"]]:

result = case_intake_agent.invoke(state)

return Command(

update={

"messages": [

AIMessage(

content=result["messages"][-1].text,

name="case_intake_agent"

)

]

},

goto="supervisor"

)

def risk_policy_checker_node(state: State) -> Command[Literal["supervisor"]]:

result = risk_policy_checker_agent.invoke(state)

return Command(

update={

"messages": [

AIMessage(

content=result["messages"][-1].text,

name="risk_policy_checker_agent"

)

]

},

goto="supervisor"

)

def lending_decision_node(state: State) -> Command[Literal["supervisor"]]:

result = lending_decision_agent.invoke(state)

return Command(

update={

"messages": [

AIMessage(

content=result["messages"][-1].text,

name="lending_decision_agent"

)

]

},

goto="supervisor"

)

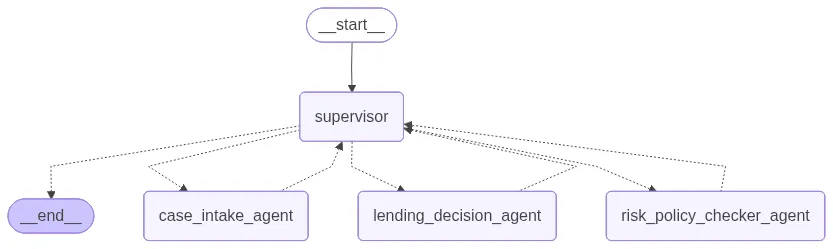

Step 9: Constructing and Visualizing the Graph

Now that we have defined our nodes, we can create a workflow graph. An entry point, individual agent nodes, and conditional edges that guide the workflow depending on the manager’s decision are defined.

graph_builder = StateGraph(State)

graph_builder.add_edge(START, "supervisor")

graph_builder.add_node("supervisor", supervisor_node)

graph_builder.add_node("case_intake_agent", case_intake_node)

graph_builder.add_node("risk_policy_checker_agent", risk_policy_checker_node)

graph_builder.add_node("lending_decision_agent", lending_decision_node)

loan_multi_agent = graph_builder.compile()

loan_multi_agentYou can visualize the graph if you have the appropriate libraries, but we will continue to use it.

Step 10: Booting the System

Now for a moment of truth. We will enter the requests in our system and follow the manager who organizes the review process. Before this we will download a function to help format the output.

# This utility file is not essential to the logic but helps format the streaming output nicely.

!gdown 1dSyjcjlFoZpYEqv4P9Oi0-kU2gIoolMB

from agent_utils import format_message

def call_agent_system(agent, prompt, verbose=False):

events = agent.stream(

{"messages": [("user", prompt)]},

{"recursion_limit": 25},

stream_mode="values"

)

for event in events:

if verbose:

format_message(event["messages"][-1])

# Display the final response from the agent as Markdown

print("nnFinal Response:n")

if event["messages"][-1].text:

display(Markdown(event["messages"][-1].text))

else:

print(event["messages"][-1].content)

# Return the overall event messages for optional downstream use

return event["messages"]

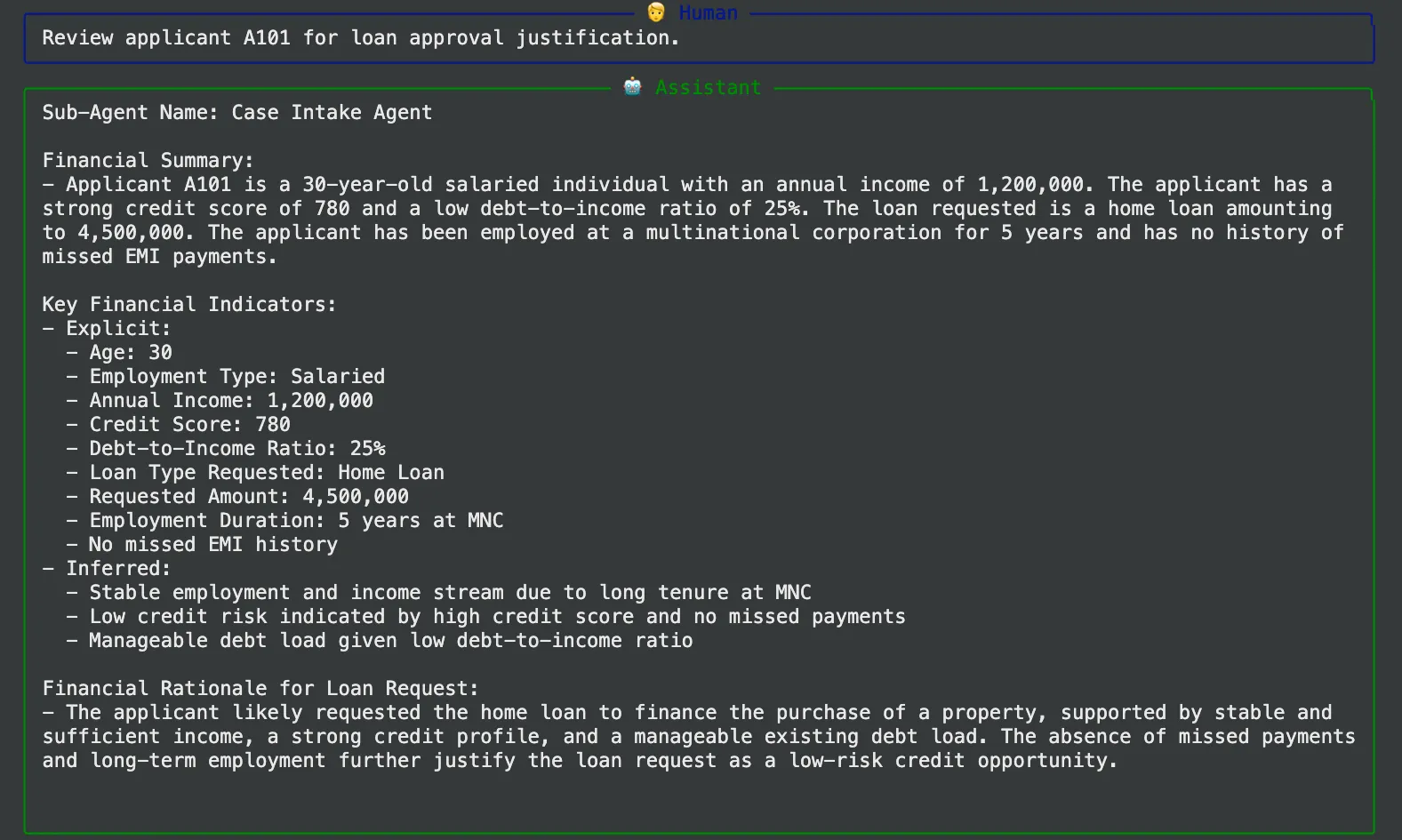

prompt = "Review applicant A101 for loan approval justification."

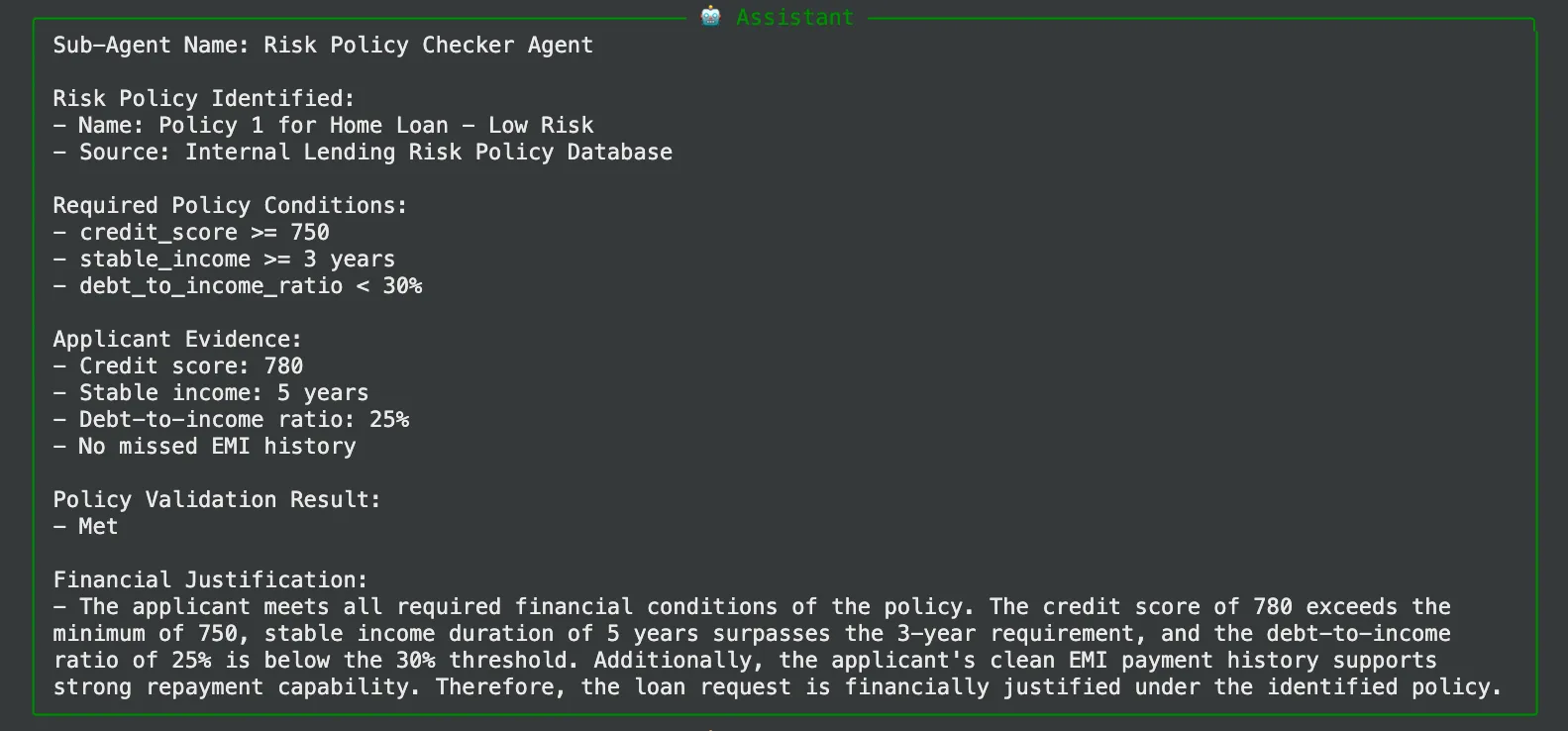

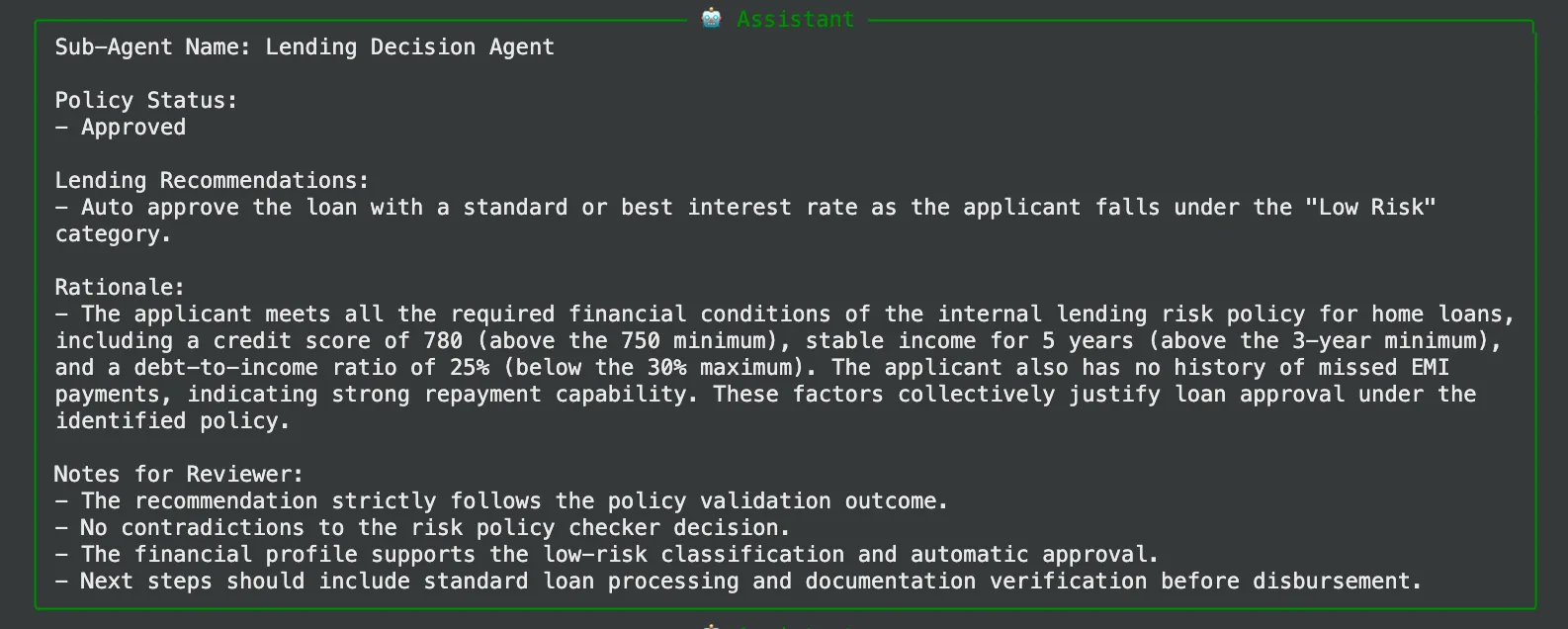

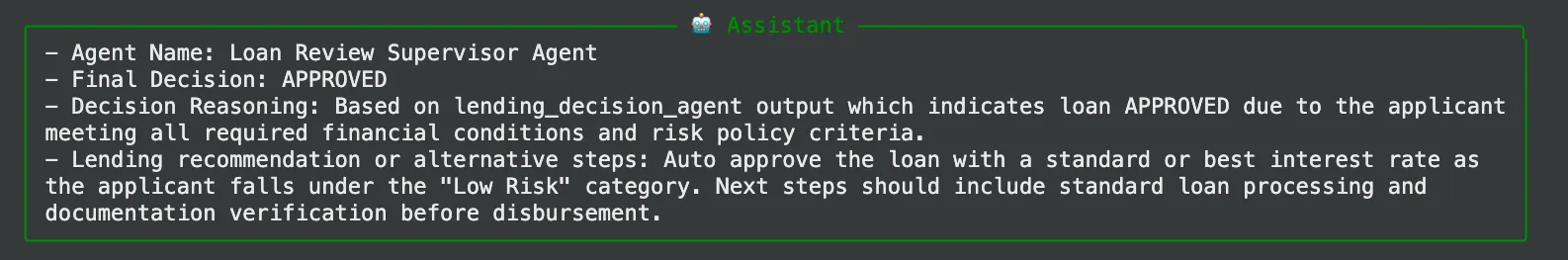

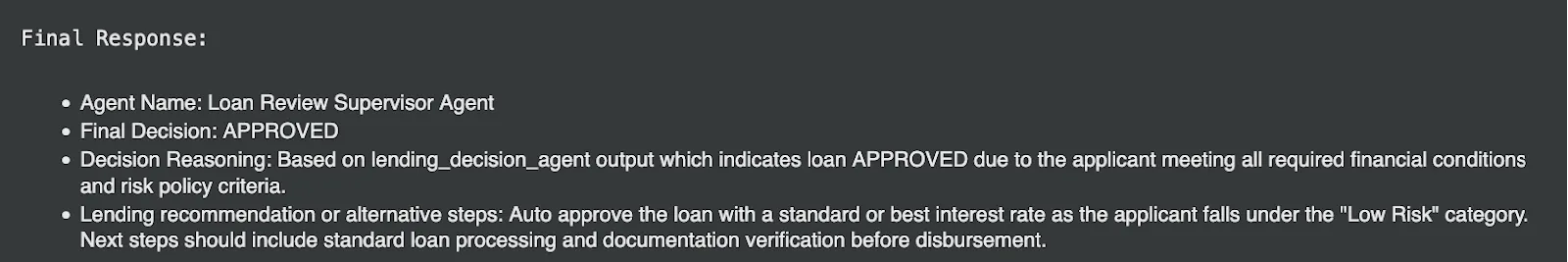

call_agent_system(loan_multi_agent, prompt, verbose=True)Output analysis:

When you run this, you’ll see a step-by-step workflow:

- manager (for caseintakeagent): The manager starts the process by directing the job to the recruiting agent.

- caseintakeagent Output: The agent will use their A101 applicant record retrieval tool and generate a clean financial summary.

- manager -> riskpolicycheckeragent: The manager realizes that the take has been done and passes the job on to the policy inspector.

- Result of Riskpolicycheckeragent: The policy agent will find that A101 is a Low Risk policy that meets all their Home Loan profile requirements.

- manager -> lendingdecisionagent: The manager now urges the final decision maker.

- The output of the decision agent: This agent will recommend automatic approval in the “Low Risk” category.

- manager -> END: When the manager arrived FINISHtreats the last worker as complete and produces a cumulative summary.

The end product will be a well-written message with no clutter like this:

Colab Notebook: Mastering Supervisor Agents.ipynb

The conclusion

Using a manager agent, we have transformed a complex business process into a predictable, robust and scalable workflow. Even a single agent trying to handle data retrieval, risk analysis, and decision making at the same time will require more complex information and be more prone to error.

The manager pattern provides a robust mental model and architectural approach to developing advanced AI systems. It allows you to remove complexity and assign different responsibility and create intelligent and automated workflows that are similar to the work of a well-coordinated team of people. The second way to deal with the monolithic challenge is not just to create an agent in the future, but a team, and always have a manager.

Frequently Asked Questions

A. Reliability and modularity are key strengths. The overall system becomes easier to build, debug, and maintain because it breaks a complex task into small steps that are handled by specialized agents, leading to predictable and consistent results.

A. Yes. In this setup, the manager reassigns work to the same agent when the output is incomplete. More advanced managers can go further by adding debugging logic or asking another agent for a second opinion.

A. While it shines in complex workflows, this pattern also handles relatively complex tasks with only two or three steps successfully. It uses logical order and makes the AI’s thought process more transparent and readable.

Sign in to continue reading and enjoy content curated by experts.