Quantonation’s second fund shows that quantum still has believers

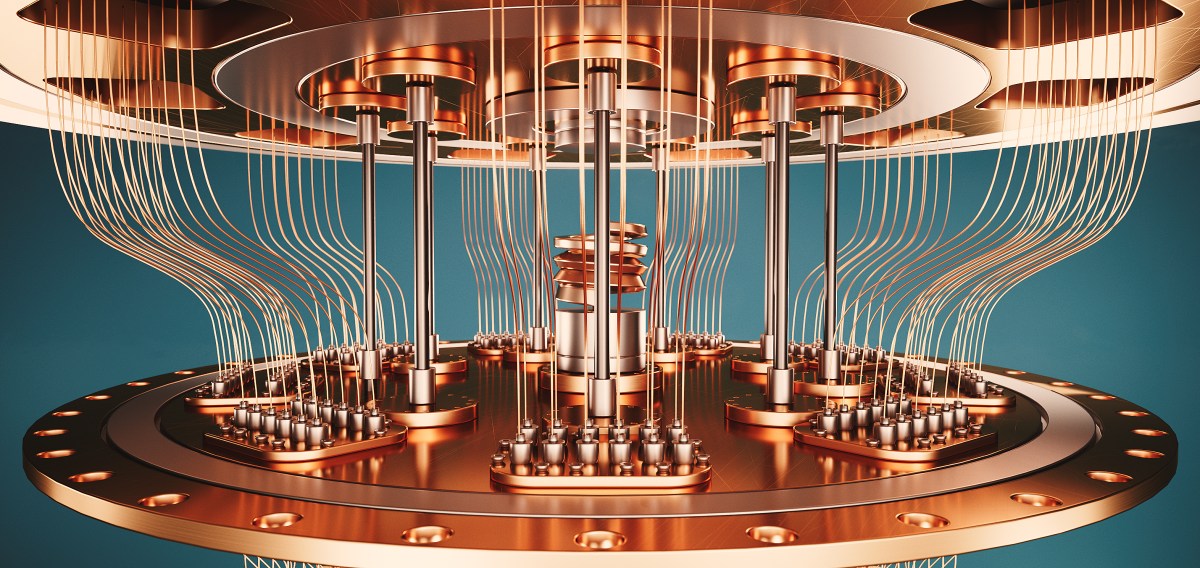

Quantum computing will not replace supercomputers by 2026, let alone reach industrial scale. However, investor interest in companies pursuing the odd quantum advantage hasn’t waned – it’s increased.

Quantonation Ventures, a venture capital firm that invests in quantum and physics-based startups, has closed its second oversubscribed fund with 220 million Euros, or about $260 million. That’s more than double the size of its original fund, and comes in addition to other signs that quantum winter is not yet here.

While some have warned that too much quantum hype and not enough tangible results will eventually cause financial collapse, the opposite has happened. Take the prediction that quantum will eventually break modern encryption: that time has no clear timeline, yet governments have joined Big Tech in the race.

In the years since the introduction of Quantonation in 2018, the field of quantum technology has not yet taken off, with both technological breakthroughs and prior demand from academic and industrial labs. As a result, there has also been a “change in the types of investment opportunities available” in its second fund, Quantonation partner Will Zeng told TechCrunch.

One example is what Zeng describes as a “pick and shovel” opportunity, with companies developing technologies that support the quantum industry. He gave the example of Dutch startup Qblox, a long-established company that sold quantum control hardware and software to Quantonation’s portfolio companies before the VC firm led a Series A partnership.

This growing ecosystem also explains why backers are doubling down on Quantonation, and why other dedicated quantum currencies like QDNL and 55 North have emerged.

“VCs realize that this is not an easy place to invest at the beginning. The technology is very specific and complex, the markets are often new, and the groups as well,” said Zeng.

Techcrunch event

Boston, MA

|

June 9, 2026

The firm’s thesis is to invest early to capture more value; but a number of quantum companies are already public, and their shares have risen in recent months. According to Bloomberg, this “quantum frenzy” is partly maintained by Nvidia, whose CEO Jensen Huang announced in June 2025 that “quantum computing is reaching an inflection point.”

Despite the fact that quantum chips may not perform much better than classical computers without a purpose-built benchmark, consensus is growing that real-life applications are just a few years away, from life sciences to innovation. That’s partly due to advances in error correction — the ability to correct errors that quantum systems are prone to.

Google’s Willow chip was a sign of a 2024 fix, but no architecture has won, and smaller players are still in the race. Zeng noted that a surprising number of companies have joined DARPA’s Quantum Benchmarking Initiative. He also believes that beyond the excitement of the public market, “there are exciting technologies that are private right now.”

In Quantonation, those hidden possibilities paint a wider canvas than just quantum chips. The second fund has already invested in 12 startups, with a target portfolio of around 25, which includes not only the software and industrial layers needed to make quantum profits a reality, but also physics-based technologies such as photonics and lasers.

This extended thesis is supported by old and new investors. According to the firm, the main investors from its first round, including Singapore’s Vertex Holdings and Bpifrance’s Fonds National d’Amorçage 2, have returned to the second fund, with new limited partners including the European Investment Fund, Grupo ACS, Novo Holdings, Planet First Partners, and Toshiba.

Quantonation’s geographic scope is international in scope. With dual headquarters in Paris and New York City, the company has supported French quantum companies including Pasqal and Quandela, but also placed bets on Asia and North America – and will continue to do so.

“In most of the areas where we grow, there is still no regional winner, […] and a lot of research has come from universities in many places,” said Zeng.